flow through entity llc

Because of the increasing use of such flow through entities for a variety of business issues at the state level continue to assume even greater prominence. A pass-through entity allows a lot of flexibility because LLC owners can choose how their business will be taxed and still retain the benefits of a flow-through entity.

How To Structure Multiple Businesses Under One S Corp In The Us Quora

Thus the income is taxed only once.

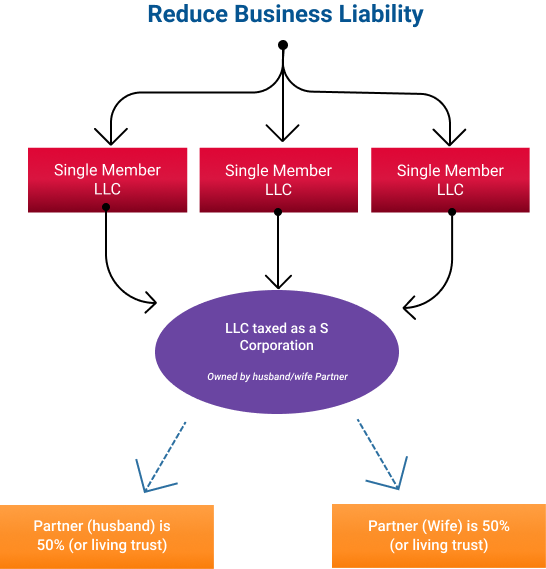

. A flow-through entity passes through its earned income directly to the shareholders or partners. Where a single member LLC. LLC flow-through is a business structure that passes the profits losses credits and expenses to the owners of the company.

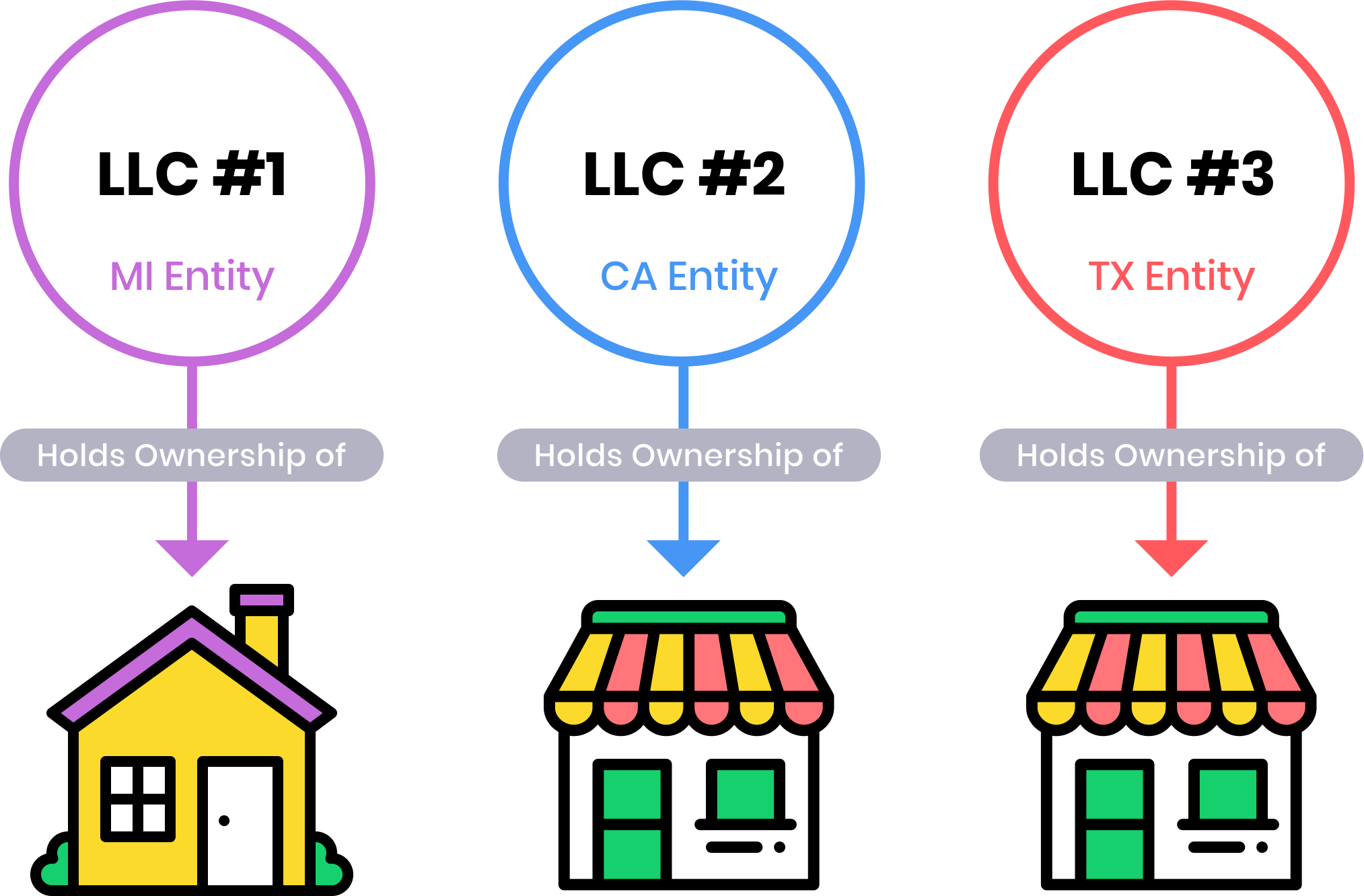

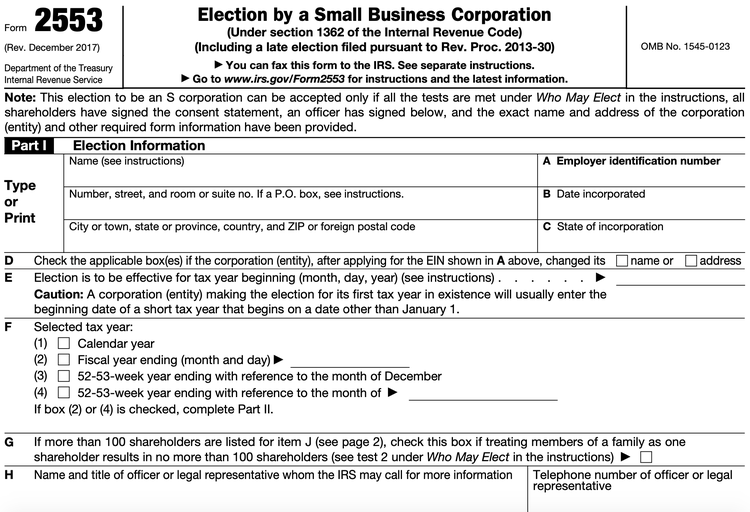

Effective January 1 2021 the Michigan flow-through entity FTE tax is levied on certain electing entities with business activity in Michigan. Tax purposes and accordingly its operations are reported on the members individual tax return. Similarly IRC Section 703a2 adjustments made at electing lower tier entities flow through to the ultimate owners and cannot be used to.

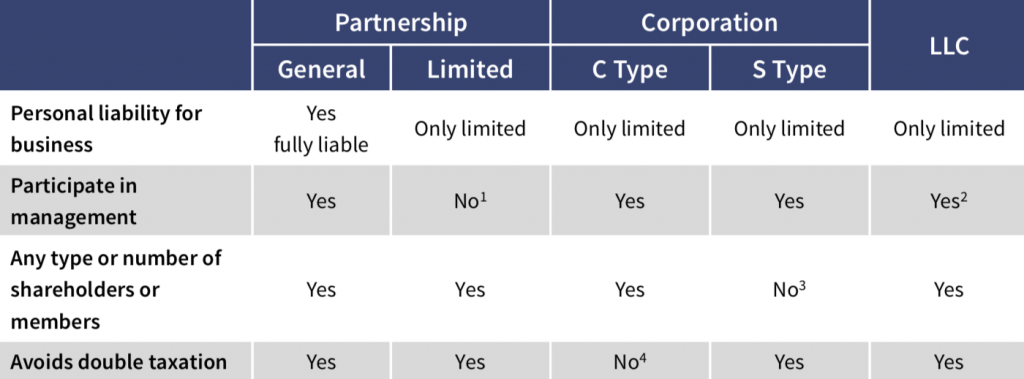

Is elected and levied on the Michigan portion of the. While the default tax treatment for an LLC is pass-through taxation owners may elect to be taxed as C corporations. There are three main types of flow-through entities.

In a pass-through entity also knows as a flow-through entity business income isnt taxed at the company level. Under proposed regulations an LLC. Types of flow-through entities.

This guidance is expected to be published in early January 2022 and will be posted to the Departments website. A flow-through entity is also called a pass-through entity. A flow-through entity also known as a pass-through entity or fiscally-transparent entity is a legal business entity where its profits flow directly to the.

You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. Therefore LLC owners cant be held personally liable for the debts and obligations of the business. An LLC is considered a pass-through entityalso called a flow-through entitywhich means it pays taxes through an individual income tax code rather than through a.

The protection of personal. LLC Income Tax Overview. A business owned and operated by a single individual.

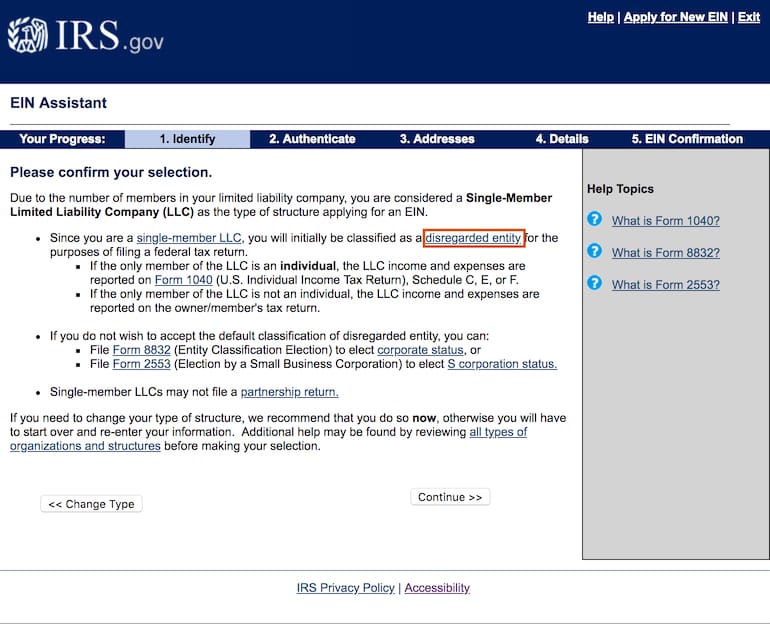

A single member LLC is considered a disregarded entity for US. Any flow-through entity taxes paid are passed proportionally up to the ultimate owners as an upper tier flow-through entity cannot apply a flow-through entity tax credit received from its lower tier. For further questions please contact the Business Taxes Division.

That is the income of the entity is treated as the income of the investors or owners. An LLC that chooses to be taxed in this way will have its. With that said the LLC isnt a separate tax entity.

A flow-through entity FTE is a legal entity where income flows through to investors or owners. Instead that income passes through or flows through to the owners and is. Updated November 25 2020.

A trust maintained primarily for the benefit of employees of a corporation or 2 or more corporations that do not deal at arms length with each other where one of the main purposes of the trust is to hold interests. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. This means that when a company is unable to pay a debt the personal property of the LLC members such as homes and cars are shielded from the creditor.

Flow Through Entities Income Taxes 2018 2019 Youtube

What Is An Llc Limited Liability Company Nolo Nolo

Strategic Entity Formation Cpa Financial Architects

Which Entity Is Best For Your Business And To Protect Your Assets

What Is An Llc Limited Liability Company Tailor Brands

Partnerships Or Llc Or S Corps Or C Corps Do You Need An Itin Being A Member Of This Entity Itincaa

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

How To Pay Yourself As An Llc Totallegal

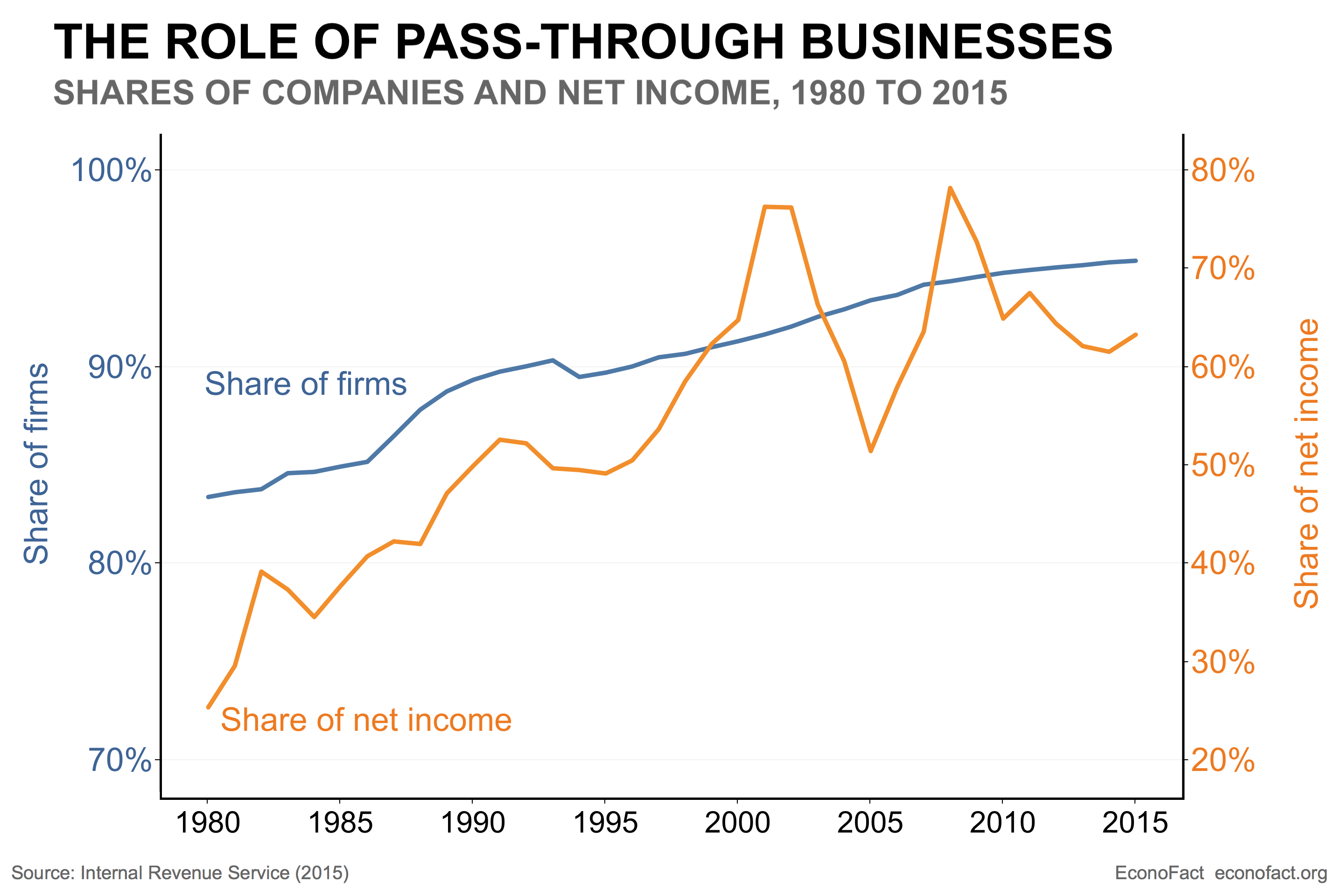

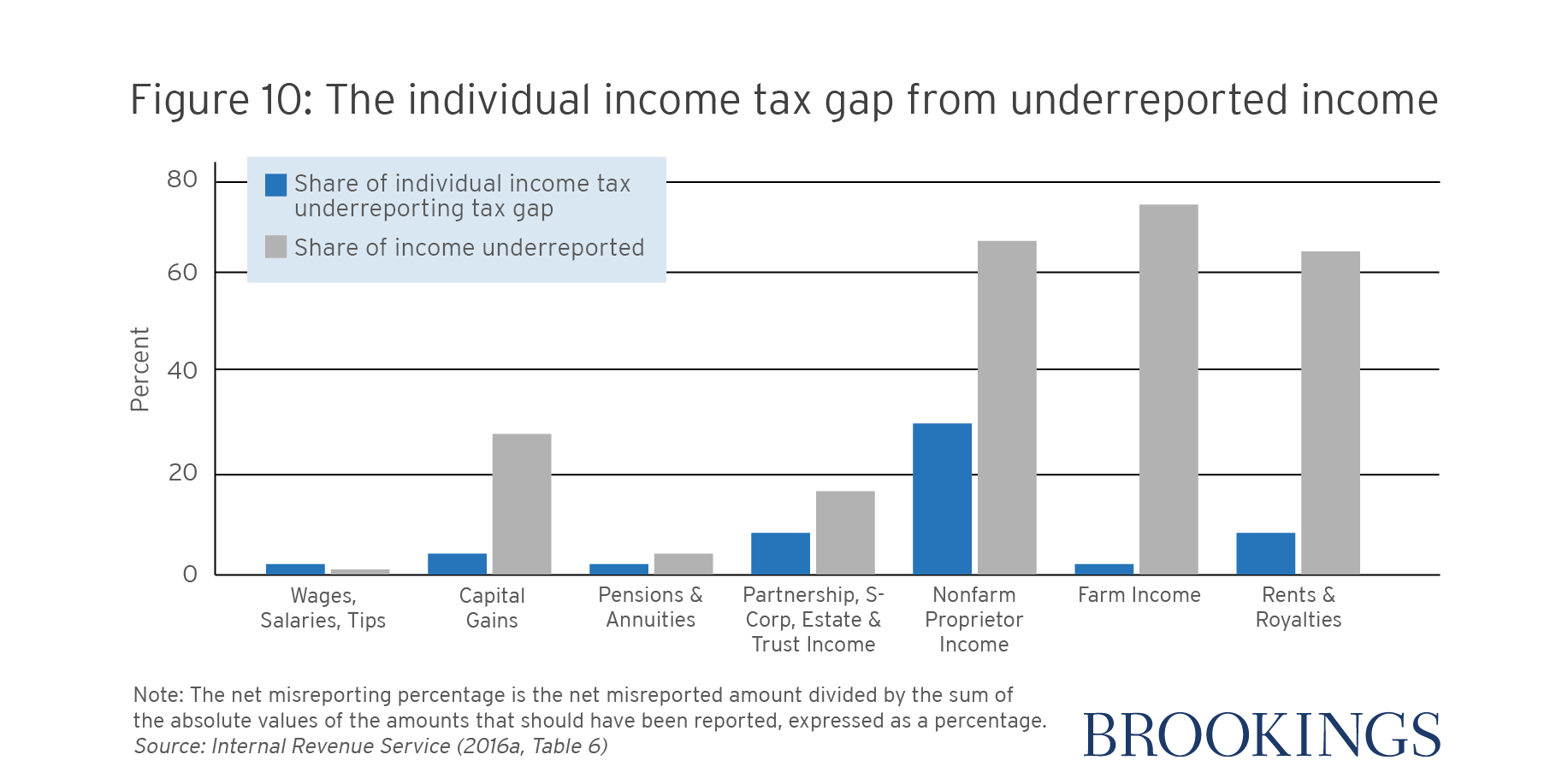

The Other 95 Taxes On Pass Through Businesses Econofact

What Is A Pass Through Entity Youtube

Pass Through Entity Definition And Types To Know Quickbooks

Should I Transfer The Title On My Rental Property To An Llc

9 Facts About Pass Through Businesses

Navigating Taxes For Llcs Top Tips To Ease The Headache

Business Entities Pros And Cons You Should Know As A Freelancer Upwork

A Beginner S Guide To Pass Through Entities

Considerations For Multi Entity Cannabis Businesses California Cannabis Cpa